Saudi Arabia's Public Investment Fund to buy games publisher for $13bn

Saudi Arabia's Public Investment Fund is prepared to spend $13 billion to acquire a leading video games publisher, and here are some possible targets.

Saudi Arabia is prepared to invest nearly $40 billion into gaming to make the country the "ultimate global hub for the games and esports sector" by the year 2030.

As announced by the Saudi Press Agency, Saudi Arabia is funding its new game-centric plan through its sovereign Public Investment Fund, and is prepared to invest a total of 142 billion riyals ($37.8 billion based on today's conversion rates) into multiple key points. The Saudi-owned Savvy Gaming Group will execute the strategy which includes strategic minority stakes in various game developers and publishers similar to Tencent's approach, as well as a buyout of a major games publisher.

The kingdom is prepared to spend up to 50 billion riyals ($13.3 billion) for the "acquisition and development of a leading game publisher to become a strategic development partner."

Savvy's investments will be based around four key pillars:

- enhancing returns

- local impact

- leaving a global footprint and expanding, leading to international games investing

- generating sustainable returns and enabling creators across the entire value chain

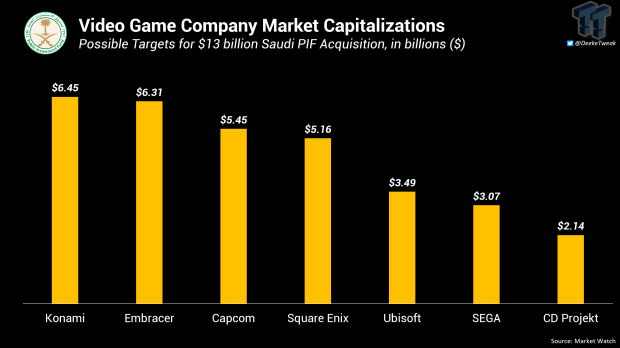

We've established some potential buyout targets based on market capitalization values, but note that actual acquisition procedures vary from country-to-country and there are complexities involved with stakes--for example, Tencent just acquired nearly 50% of the shares of Ubisoft's largest stakeholder.

Possible targets based on market capitalization alone (e.g. those below $13 billion) include:

- Konami - $6.45 billion

- Embracer Group - $5.31 billion

- Capcom - $5.45 billion

- Square Enix - $5.16 billion

- Ubisoft - $3.49 billion

- SEGA - $3.07 billion

- CD Projekt Group - $2.14 billion

(Note; Conversions based on current euro, SEK, and JPY rates)

Savvy Gaming Group has invested big into other video games companies to date, including Embracer Group ($1 billion), Nintendo ($3 billion), and owns 13.3% of Activision-Blizzard's shares.

Through Savvy Gaming Group, Saudi's PIF aims to establish 250 game developers and companies through the kingdom.

As a part of Savvy's investment strategy, the group is set to invest SAR 142 billion across four programs each with specific objectives:

- SAR 50 billion has been earmarked for the acquisition and development of a leading game publisher to become a strategic development partner.

- SAR 70 billion will see Savvy make a series of minority stake investments in key companies that support Savvy's game development agenda.

- SAR 20 billion invested into mature industry partners who add value and expertise to Savvy's portfolio.

- SAR 2 billion in diversified investments in industry disruptors to grow early-stage games and esports companies.