Brazilian regulators have myopic view on subscriptions like Game Pass

Brazil's CADE regulator approved the Microsoft-Activision merger, but has a myopic view of the growing billion-dollar video game subscription market.

Brazil's economic regulators just approved the Microsoft-Activision merger without restrictions, but its determination document is decided myopic on one of Microsoft's strongest points: Video game subscriptions.

Following its approval of Activision-Blizzard's merger with Microsoft, Brazil's Administrative Council for Economic Defense (CADE) regulatory body put out a massive 76-page document that outlines how it came to its decision. The missive is incredibly thorough and has turned out to be a treasure trove of data while providing an in-depth look at how the market is read and interpreted by anti-competitive watchdogs.

The document in itself goes through painstaking detail on key points of $196 billion video games industry, discussing market share, downstream and upstream markets, and delivers illuminating data on just how big Sony's position really is. There's just one aspect that CADE was short-sighted on, and it happens to be the core of the Xbox business: Subscriptions.

One thing I'd like to get out of the way right now: It is not CADE's prerogative to defend any company. CADE is trying to defend consumers first and the market second. It is implied what is good for consumers is good for the market. The purpose of the document is to determine if the Activision merger would not only stifle competition but potentially shut down the market itself.

The regulators mark no favors for Sony or Microsoft, however the document's representation of subscription services could use more context, data, and details.

So let's get into it. Hopefully I'll be able to provide more context on this subject.

Note: CADE warned readers that the following data "should be considered with some caution because they are based on [REDACTED]." The data is source is "claimants," which is Microsoft. So Microsoft supplied the following data points.

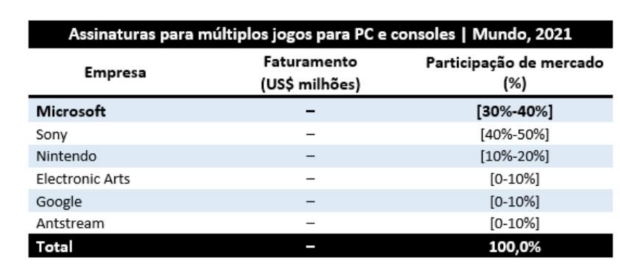

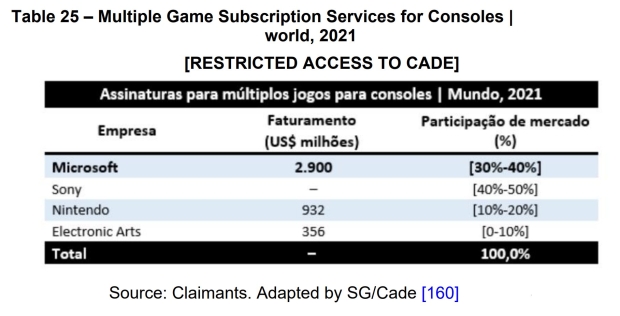

CADE published some interesting data on what it refers to as the multi-game console and PC subscription market. This includes services and subscriptions like PlayStation Plus, Game Pass, EA Play, Ubisoft+, and Nintendo Switch Online.

According to the findings, Sony is the dominant leader in combined PC and console game subscription market share with 40-50% of the market. Microsoft is at 30-40%.

These values are extremely important. Market share percentages are a big part in regulator's decision-making. If a company has a majority market share in a global industry then there is a possibility of anti-competitive practices and market shut-downs.

Sony also leads in the console subscription market with 40-50% of market share. Microsoft is not far behind though.

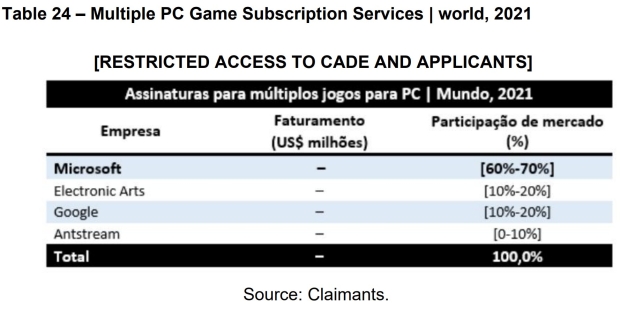

When only considering the PC market, however, Microsoft reigns with a 60-70% share.

This is because Sony does not have its own PC games subscription service (however it could be argued PS Now should count...more on that later).

Based on the data, Microsoft has a 60-70% market share on PC, with EA and Google in second place at 10-20%. How is Google on here? Probably because of Stadia, but if that's the case, PlayStation Now should also be included.

Erroneous PlayStation Now & PS Plus Classification

The second interesting point is how CADE says "PlayStation Plus started to adopt a model similar to that of Game Pass only in this year 2022, when it began to provide users with a library of downloadable games."

This isn't really the case. PlayStation Now games have been downloadable on PS4 since 2018, just a year after Game Pass was launched.

This is a big miss for the regulator, but overall the document makes clear and present points about Microsoft's subscription presence, especially how big Game Pass is on the PC subscription market.

We're also going to look at CADE's rationale when it comes to Game Pass subscription value and how it is not anti-competitive, however there are some strange points made by the regulator.

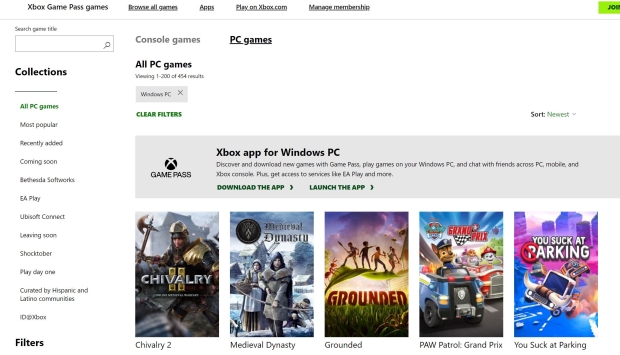

Xbox Game Pass, including the PC version, is the core for Microsoft's video games business. It combines all aspects of its game services including Xbox LIVE, the storefront, and deployable content streams, acting as an extension of its marketplace and a main driver of its userbase.

Valve and Epic Games Cannot Compete with Xbox Game Pass PC Subscription on a Like-for-Like Basis

Another interesting point that CADE makes is regarding competition in the PC subscription space. The regulator rightly asserts that Microsoft is the dominant player in PC subscriptions.

CADE asserts that publishing market share will determine overall competition in this space. The idea is that the more publishing power a company has, the more games they can release and then put on their subscription service.

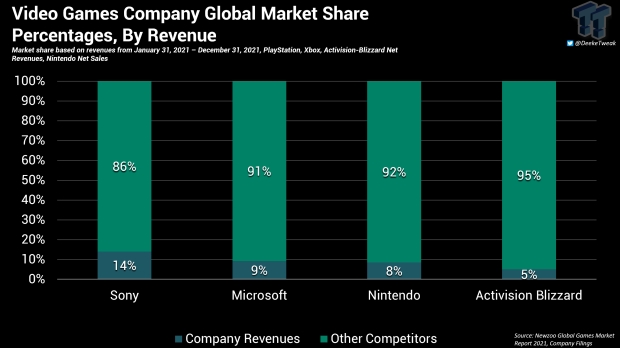

Despite capturing up to 70% of the PC subscription market share, Microsoft has less than 10% of the overall worldwide video game publishing market.

Microsoft and Activision-Blizzard combined also represent less than 10% of the PC publishing market. However when it comes to revenue share of the global video games market, the numbers are higher.

Sony, Microsoft, Nintendo, and Activision-Blizzard revenues for 2021 against global earnings for the year.

Based on our findings, combined revenues of Xbox and Activision-Blizzard in 2021 would be at $25.08 billion, which represents 14% of 2021's total global video games market earnings of $175.8 (as per Newzoo).

In any case, because Microsoft + Activision's PC publishing market share is so low, CADE believes that other competitors could rise up and offer their own services.

CADE argues that Valve and Epic Games could make their own subscription services. After all, they capture most of the PC publishing market.

This is a prime example where CADE's wide applications of market share values don't fit. CADE is looking at the industry through a specific lens and key points fall through the cracks, which leads them to make arguments built off a shaky premise.

For example, Valve and Epic Games offering a subscription services do not make a lot of sense for either company, which is likely why they haven't been done yet.

Neither Valve or Epic Games have enough content to facilitate a subscription that would rival Xbox Game Pass on PC.

Microsoft's Game Pass service isn't just hosting third-party games. Yes, third-party games make the bulk of the Game Pass subscription's 400 game+ offering, however the main drawing point to the service is the combination of day-and-date first-party game releases as well as the third-party games. Microsoft has both sides of the coin, and CADE is arguing that Epic Games and Valve could do the same.

Except...they really can't. This argument is predicated on the belief that Valve and Epic can deliver a stream of new game releases that are A) in development by a conjunction of teams and studios and B) the games actually release on the subscription service.

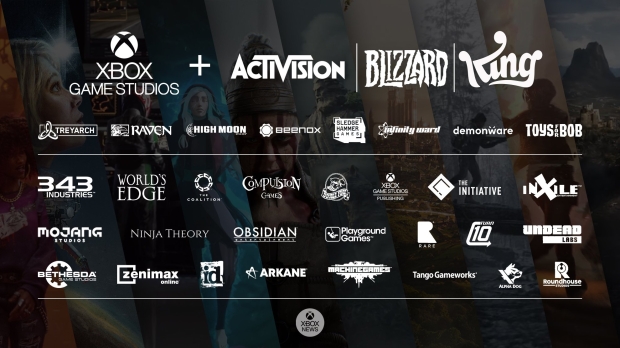

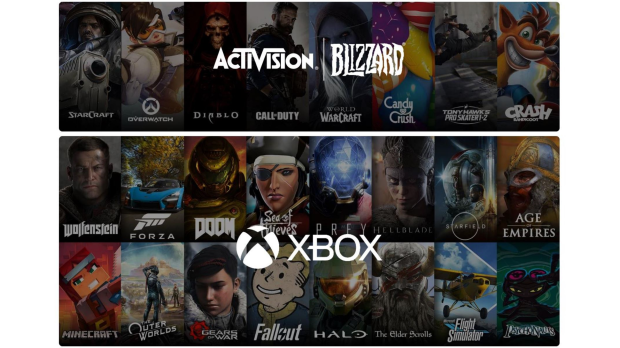

A list of the development teams in Xbox Game Studios.

(Image credit: Xbox News)

Xbox Game Studios will grow substantially after the merger. Over 3,000 people worked on Call of Duty, for example, and that's just in the Activision segment. The entire company has over 9,000 employees.

Microsoft's sheer volume of game development teams under its Xbox Studios banner are the workhorses that provide content for Game Pass. Neither Valve or Epic Games have these kinds of teams, developers, or entire separate publishing divisions (Microsoft for instance, owns Bethesda, who was a games publisher before being acquired in 2021).

As per research, Valve has up to 500 employees. Epic Games has 2,200+ employees. These companies do not have enough manpower to churn out the kind of volume that Microsoft currently does--which will only grow after the merger.

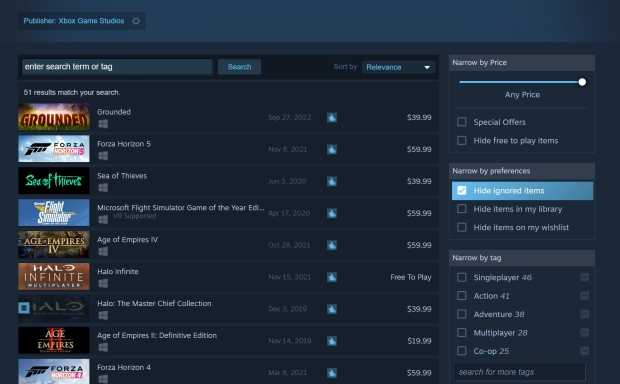

Microsoft offers 454 PC games on its PC Game Pass subscription service, which includes a multitude of first-party games across all of its developers and publishers.

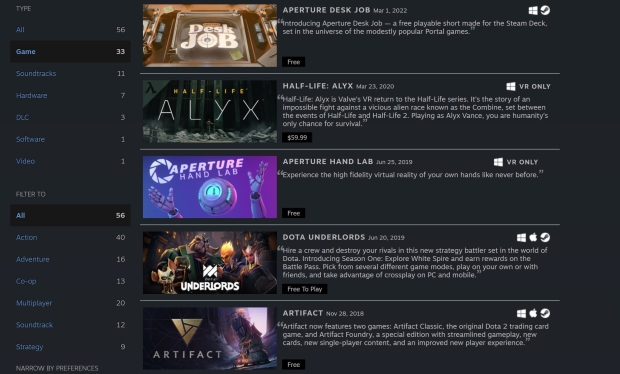

Valve and Epic Games do not typically release new games very often. Valve's recent game Half-Life Alyx was the first major first-party premium game the company had released in years. The other titles are free-to-play games that would not necessitate or even justify a subscription service.

Epic Games hasn't released a new game since Fortnite Save the World in 2020. However, Epic Games is more prolific than Valve and has its own Epic Games Publishing division which has released and is working on a total of six games.

Again, this sparse offering of titles does not nearly represent the same number of first-party games offered on Game Pass.

If Valve or Epic Games created their own PC game subscription model, it would primarily be made up of third-party games and be the opposite of Ubisoft+ or EA Play, which exclusively offers blanket access to those publishers' titles.

The reality is that there are only two other competitors that could offer something similar to Game Pass: Nintendo and Sony, who both have access to a treasure trove of retro, evergreen, and new first-party games and franchises that could deliver the much-needed proprietary games presence on such a subscription.

It's also worth mentioning that only platform-holders could adequately compete with Xbox Game Pass PC on a like-for-like level. This is because that platform-holders broker deals to host, distribute, and sell third-party games on their storefronts. It's not enough to just have games and IP; companies also have to have the market infrastructure to actually compete.

EA has teamed up with Game Pass to add value to the service in a move that seems to recognize EA's shortfalls in this particular market, namely with its ability to offer any sort of competitor games on its subscription service.

This is why EA Play and Ubisoft+ are lower in market share. They have enough content, but do not have a storefront or established partnership infrastructure to facilitate third-party games content, which is the second half of the Game Pass business model.

The reverse is also true. As in Valve's and Epic Games' case, it is not enough to have a commanding storefront presence with exceptional market reach. To combat or adequately compete against the Game Pass model on a like-for-like basis, companies must also have the first-party content to drive value and push adoption rates.

As such, is it determined that no company is currently competing with Xbox Game Pass on PC in this way.

Left: Valve only has 33 games on its own storefront platform, whereas Microsoft is selling 51 games (right). Microsoft's sheer volume of available first-party games, IP, and content far outstrips the likes of Valve and Epic Games.

It's also worth mentioning that Microsoft currently has more games on Valve's Steam storefront than Valve does. Microsoft is selling 51 games on Steam, and Valve only has 33 games on its own store.

After the deal, Microsoft will have a treasure trove of valuable IPs that will significantly boost the appeal of Game Pass. Content, games, and IP are half of the main driving points to a subscription. The other is value. Microsoft is in a better position that Sony or Nintendo to combine these two points.

Activision has eight franchises that have each made over $1 billion. After the merger, these billion-dollar franchises will join Microsoft's other mega-hit IPs like The Elder Scrolls, Halo, Doom, and Fallout.

Therefore this argument appears not to be valid and the application of market share values aren't enough to fully represent or discuss the PC subscription market.

Context on Gaming's Most Valuable KPI: Monthly Active Users

There's another thing that CADE does not consider in enough depth: Engagement.

When the Microsoft-Activision merger closes, the combination of the two video games companies will reach a combined audience that exceeds 300 million monthly active users.

The importance of MAUs is not discussed in length in the document. MAUs are incredibly vital indicators that relay information about the past, present, and future of any service, especially if said service is a subscription driven by online-driven games.

MAUs are important to different models for different reasons.

For live service games like Call of Duty, and Overwatch, they determine popularity and can reflect player sentiment. If user counts drop it could because of an update that people didn't like, or a competitor is taking players' attention. In this way, MAUs are indirectly involved with revenues.

However, MAUs also help determine monetization rates of a service game. While not always necessarily true, more players represents more monetization opportunities. Games like Fallout 76, for example, are outliers with a more tight-knit core playerbase that can be monetized over time versus a mega-hit like Call of Duty Warzone, which is much more broad. So it is apt to say MAUs in service games can be both indirectly and directly involved with revenues.

For subscriptions, MAUs are obvious indicators of actual subscriber counts and tie directly in with monetization and revenues. Users have to pay to access subscription content. If MAUs drop, then less people are paying. In this way, MAUs are directly involved with revenues.

On a platform level, MAUs reflect how many people are online in frameworks like the PlayStation Network and Xbox LIVE. These online infrastructures are also tied to digital storefronts like the PlayStation Store and Microsoft Store. The more people that are online, the more likely it is they will spend money (or time, which has also been commoditized via microtransactions and other methods) in the platform. This kind of investment means that MAUs are both indirectly and directly involved with revenues in regards to platforms.

All of these are synergized with one another. Platform MAUs include both subscriptions and service game MAUs, and subscriptions can also include service game MAUs. This is especially true for Game Pass, which houses many live service games...and will contain even more with the inclusion of Activision-Blizzard properties.

Therefore it is correct to say that MAUs can be correlated with revenues and market share.

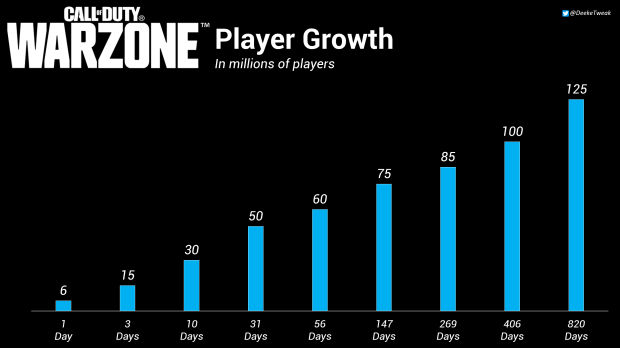

Call of Duty Warzone, which Activision released in March 2020, has seen incredible growth in player counts in the last 2+ years.

It's vital that each video games company grow or maintain MAUs in order to properly sell games, subscriptions, and generate revenue from advertisements and long-term player investment.

Based on company data made publicly available online, Microsoft will be in an incredibly dominant position in combined monthly active users (MAUs) across PC, consoles, and mobiles when compared to other platform-holders like Nintendo and Sony.

Again, this is not enough to deem the deal anti-competitive. It is unknown how Microsoft's post-merger MAUs will fit against other market competitors.

The purpose of this particular passage is to observe and examine MAUs as they relate to subscription services, both directly and indirectly where applicable.

So let's take a look at the MAUs for PlayStation, Xbox, and Activision-Blizzard.

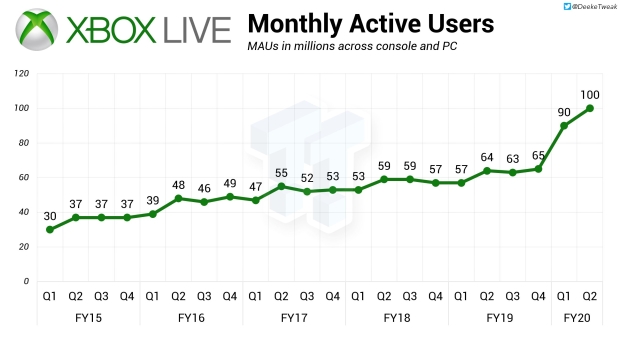

Xbox MAUs

According to our data, the last reported MAUs for Xbox were 100 million in Q2'2020. That's during October - December 2019.

Remember that Xbox LIVE MAUs also include Game Pass subscribers, because Xbox LIVE is included with Game Pass. Xbox LIVE MAUs also include PC players because that framework runs on PC, too.

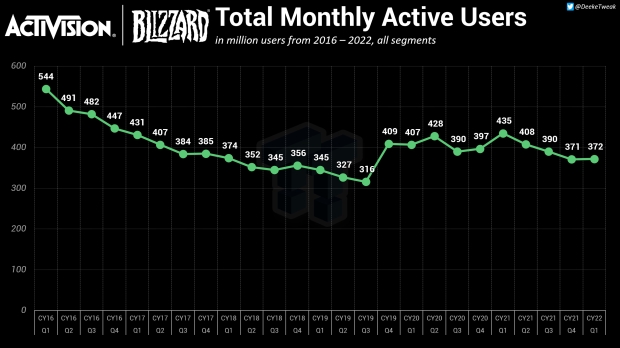

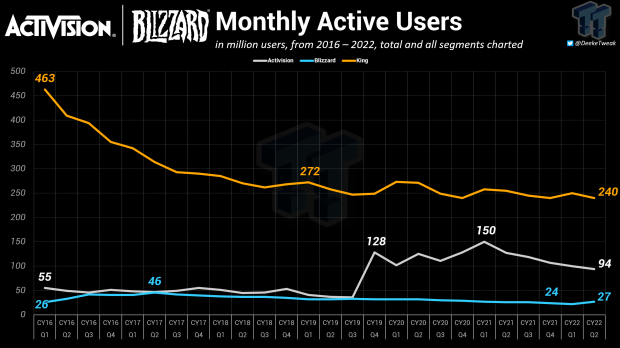

Activision-Blizzard MAUs

These MAUs overlap with both Xbox and PlayStation MAUs. That is, games on Activision and Blizzard are released on both Xbox and PlayStation.

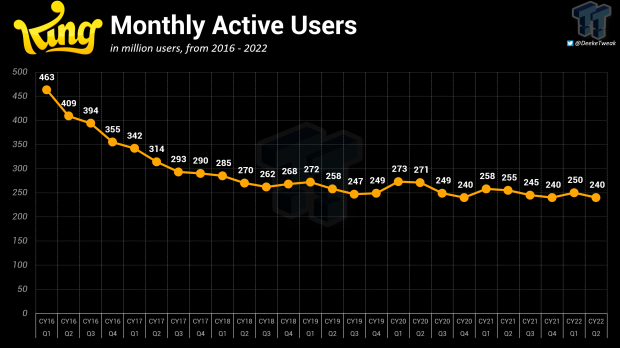

However, Activision's most popular segment is not on either Xbox or PlayStation platform. King's MAUs are exclusively on mobile and are not shared on either ecosystem.

King's MAUs are by far the highest in the three-segment company. For example, during the holiday 2019 quarter, King had 249 million MAUs. That's nearly 150 million more users engaged with King products than the entirety of the Xbox LIVE infrastructure.

For the sake of argument, we'll combine these periods together because they include the last-reported Xbox MAUs. To remove the overlap, let's not count either Activision or Blizzard MAUs because a portion of those are both on Xbox and PlayStation.

With just King's and Xbox's MAUs together, we see an incredible 349 million that would be engaged in those games, platforms, and ecosystems.

This number should be even higher with Activision's and Blizzard's MAUs together, primarily via games available on Steam and Battle.net.

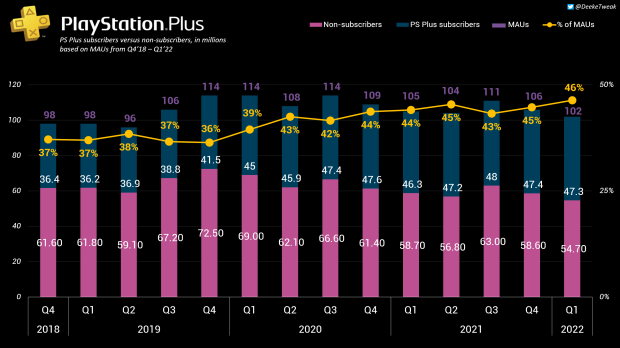

PlayStation MAUs

PlayStation MAUs typically fluctuate according to game releases, but hit high points in both 2019 and 2020 following high-profile releases like Call of Duty Warzone and Black Ops Cold War in the latter year.

As of the according period of Holiday 2019, PlayStation MAUs were at 106 million, just beating Xbox MAUs.

In this scenario, the combination of Xbox and King MAUs alone would beat PlayStation MAUs by 3 times over.

Despite Sony's market share leadership on both PC and consoles, which appears to be based on the subscription numbers and revenues generated, we see that the combination of Microsoft and Activision-Blizzard will deliver more than triple monthly active users than those on PlayStation.

Wrap-Up

It's important to note that I do not necessarily disagree with CADE's determination on the Activision-Blizzard merger. The regulatory body makes an incredibly in-depth flow of logical conclusions and presents reams of information in a concise way.

The purpose of this article was to outline a few shortcomings that I believe were not adequately addressed in CADE's document. The regulators have sifted through a dearth of data, figures, and advisories to make their assessment on the merger and it's not surprising some things lacked critical context and may have not been represented or explained properly, however the most important and critical matters have been addressed.

CADE asserts that while exclusivity will affect competitors like Sony, that Activision's combination with Microsoft does not pose the threat of effectively shutting down the market or forcing its competitors out of business.