Starbreeze may sell Payday IP if it doesn't get more funds by Q4 2020

Starbreeze has a 2020 deadline to secure more cash or a Payday 3 publishing deal.

Payday owner Starbreeze is still in dire straits. If the company doesn't get extra cash or secure a publishing deal by Q4 2020, it may have to start liquidating assets. The Payday franchise could be the first to go.

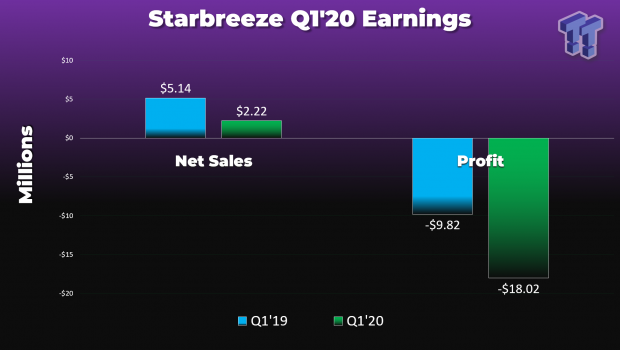

After disastrous losses and debt issues, Starbreeze is still hanging on. The company is still losing a lot of money, but the good news is now it's losing less money. As of Q1'2020, Starbreeze's losses were down a big 41% to $9.82 million (97 million SEK), compared to the $18 million (167 million SEK) it lost in 2019.

In the earnings report, Starbreeze CEO Mikael Nermark expressed cautious optimism for the company's roadmap, saying that Payday 2 demand has increased in the quarter. Payday is literally Starbreeze's only cash crop, and Payday 2 made up 98% of total revenues for the quarter.

The game has now sold more than 10 million copies on Steam, which allows Starbreeze to keep 75% of all sales revenues from the game from herein out.

Starbreeze has yet to secure a publishing deal for Payday 3, and COVID-19 has thrown a wrench in these negotiations. Coronavirus hasn't actually had a material impact on game development, and Starbreeze says it's transitioned to a full work-from-home environment with very minimal changes.

This brings us to the main point of the story.

If Starbreeze can't secure any additional funds by Q4 2020, either in the form of a publishing agreement with a set fee for publishing rights, or extra cash from investment firms, the company will have to start liquidating assets. And right now it only really has one asset: Payday.

"Starbreeze exited reconstruction in December 2019 and in January 2020 the outstanding convertible bond was extended to December 2024. Without additional financing, liquidity injections from divestitures or distribution agreements for Payday 3, the company expects a liquidity shortfall in the fourth quarter of 2020. This entails risk that the company will not have sufficient secured funds to guarantee continued operations for the next 12 months.

"In the opinion of the board of directors, Starbreeze will be able to close a publishing agreement for PAYDAY 3 and PAYDAY: Crime War. However, due to the ongoing Covid-19 pandemic, the board of directors cannot guarantee that the publishing agreement will be executed by mid-year 2020."

It's very likely Starbreeze will be able to make a deal. Payday is huge and shows strong monetization potential for a long-term years-long engagement game.

But at the same time, if this doesn't happen...then we could see publishers like EA, Activision-Blizzard, or maybe even Ubisoft nab the franchise. I bet it'd likely go to someone like THQ Nordic.